Pre Crisis Market with Investment Aircraft

The pre-crisis market also influences the Investment Aircraft market. Briefly looking back to 2019 as a starting point, the year showed a lower worldwide economic growth of 2.9% (2018: 3.6%) which affected most regions and was partially influenced by lower worldwide trade, inter alia due to the conflict between the US and China. As a result, in the aviation market passenger growth slowed down to 4.2% in 2019 declining below the long-term trend (5.5%) for the first time in 11 years.

In its industry outlook released in December 2019, IATA forecasted a revenue growth of 4.0% to USD 872 bn for 2020. This was in line with a projected worldwide RPK growth of 4.1% in the passenger segment, marking the eleventh consecutive year of passenger growth. Especially South East Asian airlines were expected to show a 20% increase in net profits while European and US markets were to remain strong.

This forecast was rendered obsolete by the spreading of COVID-19 throughout China and Asia in January / February 2020.

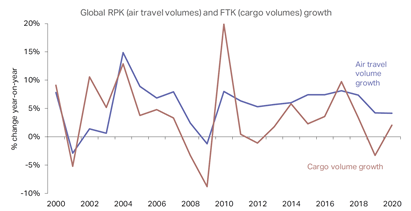

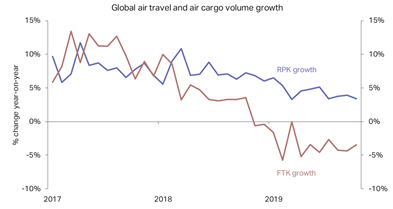

Moderate air travel and cargo forecast

Overall global slowdown in air travel and cargo

Current Situation (24.03.2020)

Meanwhile, COVID-19 continued and continues to spread rapidly around the world. While the situation is improving in China and even in East Asia, it is now rapidly declining in the Middle East, Europe and the US.

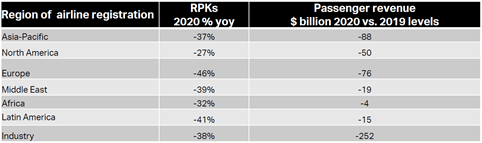

Travel restrictions are now closing down international aviation where markets with severe restrictions cover 98% of global passenger revenues. A loss of passenger revenue amounting to USD 252 bn worldwide is currently forecast for 2020, assuming, this three months of lockdown and gradual recovery thereafter.

A mitigating factor will be the dramatic fall in oil prices to levels last seen in 2016 coinciding with COVID-19 which will help to soften the impact of lower demand in the passenger and freight segment. However positive impact could be delayed for airlines which already hedged their fuel position for 2020.

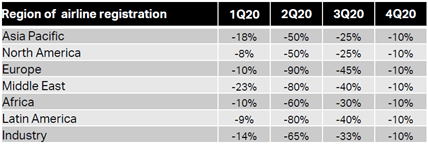

Capacity (% change year-on-year) assumptions

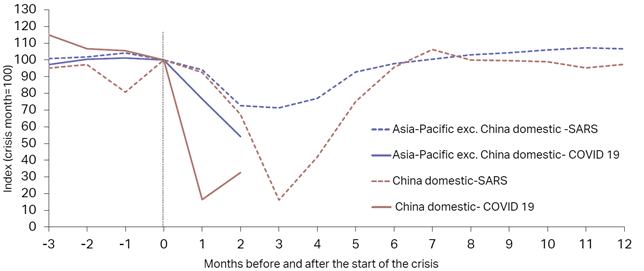

Nevertheless, in the Chinese domestic air travel a turning point seems to be reached already. While compared to SARS the initial decline has been much more severe due to China’s increased role in world trade, the turning point has occurred two months earlier.

At the same time passenger yields are stabilizing on China’s domestic market while international yields are still 25% below the prior year.

Passenger Numbers

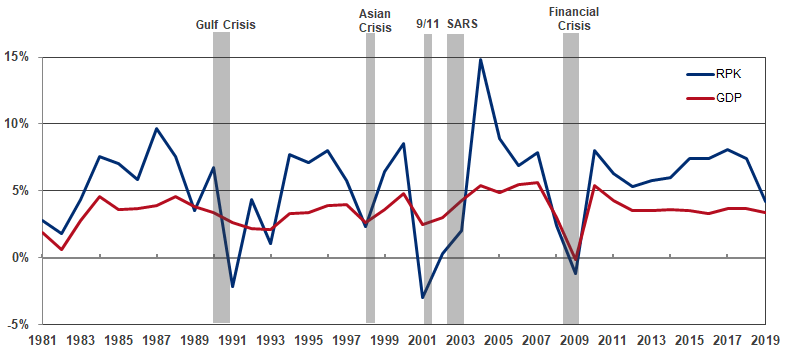

At this point the correlation between economic growth and growth of the aviation industry (“GDP Correlation”) should be kept in mind. Reflecting on travel behavior during economical challenging times, individual travel to visit friends and relatives or vacation travel will be restricted due to income uncertainty as will business travel due to corporate savings and tightened travel policies. This correlation will remain valid even after the current crisis.

Year-on-Year Change of the World Annual Traffic (RPK) and Gross Domestic Product (GDP)

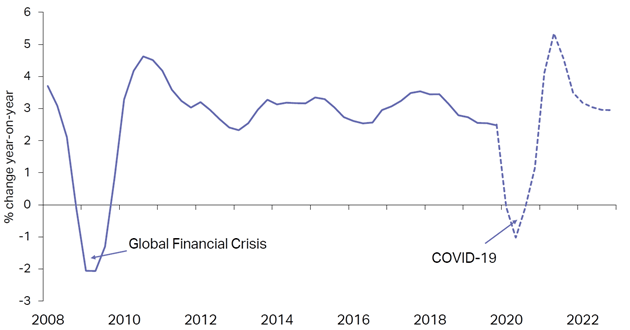

To address the crisis situation, governments are implementing huge fiscal stimuli equivalent to spending in an amount of between

10 and 20% of annual GDP.

These fiscal stimuli are expected to stop the economic recession expected for 2020 in exceeding that of the World Financial Crisis.

Global GDP growth

Analysis

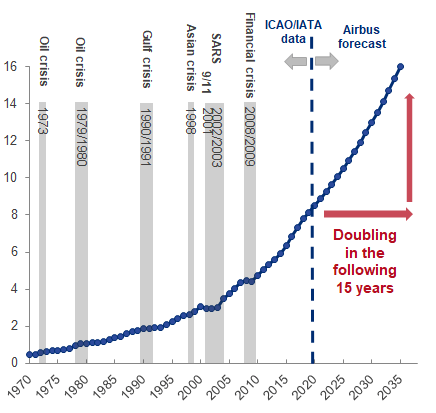

Irrespective of the short-term development of the COVID-19 crisis which creates high anxieties worldwide (also reflected in significant stock market declines and short-term irrational behavior), the aviation market “benefits” from the fact that it is a cyclical market which has weathered various crises and provides a wealth of datapoints to refer to. In this regard, the lessons of previous crises and their medium to long-term effects on the market provide the basis for consistently successful market players.

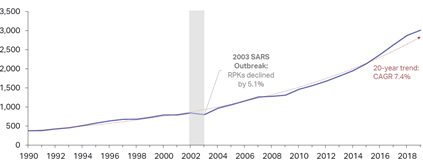

Reflecting on the Asia-Pacific market, actually in the past only SARS lead to an annual market decline following which the market rapidly returned to its long-term stable growth trend.

Asia- Pacific Airliners´ Passenger kilometers flown (RPKs)

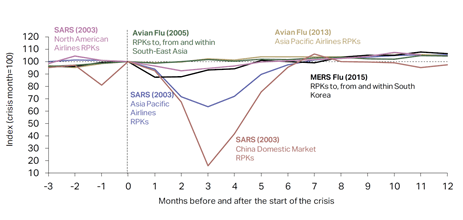

When looking at previous disease outbreaks (such as SARS, MERS, Avian Flu), the highest impact on Investment Aircraft tended to materialize after three months and at the same time a recovery to pre-outbreak levels was recorded after six to seven months.

Impact of past disease outbreaks on aviation

The term until recovery is still unpredictable and may differ in the current case of COVID-19. Nevertheless, the SARS experience, but also other crises such as 9/11 and the World Financial Crisis have confirmed in multiple instances that the aviation industry is prone to rebound to its original growth path. Hence the current situation should be seen as temporary.

Other than in previous crises, the airline industry benefits from an unprecedented period of profitability spanning a whole decade and resulting in significant cash reserves at the major airlines.

The situation may nevertheless lead to serious problems for weaker airlines. On the other hand, based on their prior experience of state actions during the World Financial Crisis, governments seem to be more willing to support local airlines and help them weather this temporary crisis, as demonstrated by the economic stimuli already announced.

World Traffic Volume in RPK (in millions)

Market Potential for Investment Aircraft

As shown on the previous slides, based on the experience of the past decades and prior industry crises, a rationale view absent of the current situation of emotional news chasing each other dictates that the aviation industry will weather the current crisis and will return to its long-term stable growth path.

The aviation market correlates with GDP growth, which can be expected to return. With a stabilized economic situation and growing income, individual travel demand to visit friends and relatives as well as vacation travel is certain to resume, as is business travel in a globalized economy. While pundits propagate that decentralized home office work will lead to a decline in future travel, we believe that especially the current experience shows, how invaluable personal face to face contacts are.

In this situation the strength of airline credits and liquidity is absolute key to bridge the duration of the crisis until markets rebound. Our in the process of being structured Regional Aircraft Fund management’s experience of successfully weathering several market crises and using these to secure attractive transactions with above-average terms and conditions, provide it with a blueprint for the current market environment to identify airline clients with strong financials and state backing together with state-of-the-art aircraft all of which are certain to benefit from the resulting market consolidation.

With even prime airlines looking to raise cash, the current environment allows for sale/leaseback opportunities as well as other problem-solving products at attractive terms and conditions for investors with committed equity available on time. Furthermore, as aircraft values will drop temporarily, we will be able to source best in class assets at favorable pricing provided sufficient capital can be demonstrated (closing certainty).

Experienced Partners

Our aircraft manager for Investment Aircraft and our in the process of being structured Regional Aircraft Fund can look back on the experience of well over 100 aircraft transactions with a volume of more than USD 30 billion and is managing partner of a leasing platform for wide-body aircraft. The professionalism of the players involved is crucial for purchasing, negotiating terms and conditions, object management and the reusability of the aircraft. The aircraft manager’s portfolios show no defaults whatsoever.

Part two of this blog regional aircraft fund can be found here

Prime Invest designs club deals for tangible asset investments. Our activities focus on real estate investments, from project development to portfolio properties and developments of multifamily facilities in the USA, as well as opportunities in the aviation sector. Our Diversified Regional Aircraft Fund offers risk diversification in a sustainably growing market that will also survive crises such as Corona. In doing so, we attach importance to aircraft types that are characterized by the lowest possible kerosene consumption. We welcome the efforts towards climate-neutral flying.

We thank you for your attention and are available at all times to answer any further questions you may have.